Appreciation Continues to be Evident Amid Decreasing Inventory

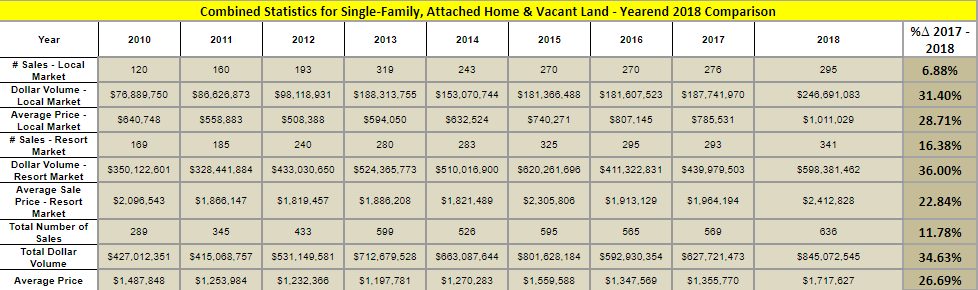

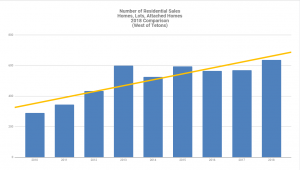

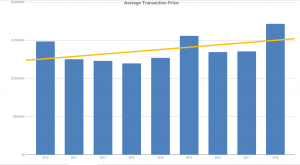

When viewing data through the mid-point of December 2018 (a composite of single-family homes, attached homes, and single-family homesites), the Teton County Real Estate Market is noted to have reported a number of sales that is approximately 12% greater in 2018 than that of the previous year. This increase in demand, and an inventory of available properties that has decreased approximately 7% from last year’s numbers, combined to provide continued upward pressure on prices through 2018. Observing sales and resales of the same or similar properties, mid-tier-priced properties between $800,000 and $2,000,000 provided the indication of appreciation in excess of 10% when annualized. Upper-end Resort properties in excess of $3MM exhibited appreciation rates even greater than this range, although this indication was influenced by instances of investors successfully speculating that some developer initial offering prices were below-market. The most price conscious segment of the market (typically comprised of attached home less than $400,000) showed some indication of leveling off trend. It would be reasonable to assume that homes in this segment would have appreciation that would be more dependent on local wage earning potential rather than outside pressure, thereby moderating appreciation rates in this price category. That said, instances refuting this observation certainly existed. Increased activity in the higher-priced segments of the Teton County Real Estate Market served to skew composite averages upward with, as an example, the average price of all combined sales increasing over 25%, a figure that exceeds that of price growth as measured by the sale and resale of similar properties.

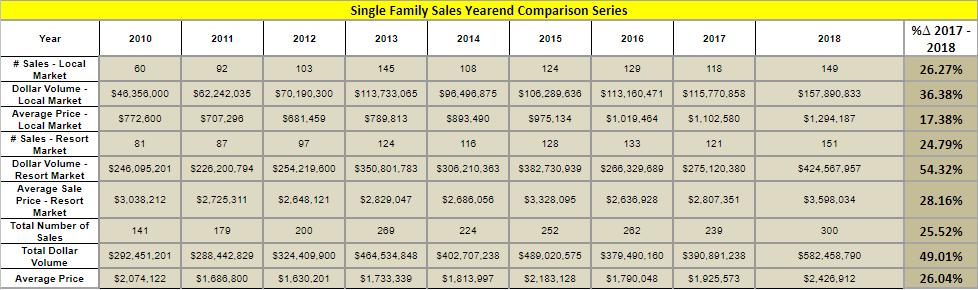

Single-Family Home Sales Trends Through December 2018

Despite a lower inventory of active listings, the single-family home market showed an increase for total number of sales of approximately 25%. Average sales prices increased in a similar magnitude as a result the combined effects of real price growth and the increasing prevalence of higher-end property types. While both the Local and Resort markets increased in number of sales by a similar magnitude, the upper echelons of the single-family market led the way with a 26% increase in the average price. As previously alluded to, such an average is partially attributed to the changing composition of the body of sold data points and is not to be misconstrued as simply an annual appreciation rate. In this regard, it was noted that 2018 saw the following trends:

- Higher-end properties in the Town of Jackson were led by East Jackson with 37 sales (as compared to the previous year’s 28 sales). The average sales price of 2018 homes in this market segment was up over $670,000 and contained six sales above $2,000,000. In consideration of this, an argument can now be made that East Jackson is not a part of the Local market and caters more to out-of-town property buyers. Similarly, one sale in the Gill Addition (which was not included in the above tally) topped the $6MM mark.

- Teton Pines reported five more single-family homes sales in 2018, nearly doubling the previous year’s counting. The average price of these sales increased from $2.3MM to $3.6MM.

- Solitude Subdivision in the North of Town Market area increased its sales volume from three sales in 2017 to nine sales in 2018, adding an approximate $14MM in sales volume to the high-end sales segment.

- The influence of high-end / Resort market segment is further observed when noting that 2018 saw 36 sales at or above $4MM, with the average price of these sales being nearly $10MM. By comparison, 2017 saw only 26 sales at or above $4MM, with the average price of these sales being less than $7MM.

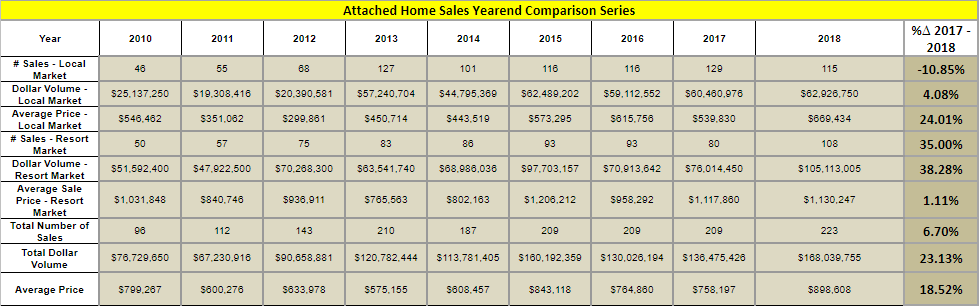

Attached Home Sales Trends Through December 2018

Similar to the single-family home market, the attached home market (condominium / townhouse) was led by the higher-priced Resort market segment. In fact, due to a lack of inventory to sell, the Local market actually experienced a decrease in the number of sales (by approximately 10%). Prices showed appreciation in both the Local and Resort Market, with some indication that the most price-conscious homes ($400,000 or less) may be starting to plateau. The average price of attached homes was up over 18%. Contributing to the increase in average price of the attached home market was the continued growth of the upper-end attached home market in town of Jackson such as 810 West which saw 5 sales averaging over $1.6MM – perhaps making an argument for their inclusion in the Resort / second home market segment as opposed to their current categorization as a property in the Local market segment. Teton Village condominiums also contributed to the upward track of attached homes in Teton County, with an observed increase in activity in both older product and the newer “condo-tel” type homes such as Teton Mountain Lodge and Snake River Lodge and Spa. The latter of these housing types had an increase in volume in 2018 up to a year end tally of 24 units (compared to 17 units the year before).

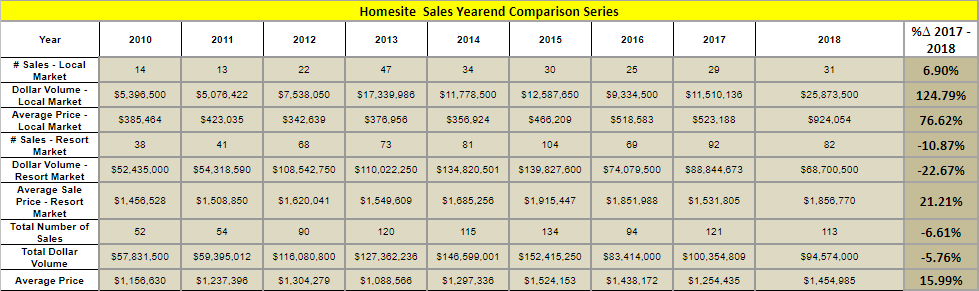

Vacant Land Sales Trends

Similar to the single-family home market, the attached home market (condominium / townhouse) was led by the higher-priced Resort market segment. In fact, due to a lack of inventory to sell, the Local market actually experienced a decrease in the number of sales (by approximately 10%). Prices showed appreciation in both the Local and Resort Market, with some indication that the most price-conscious homes ($400,000 or less) may be starting to plateau. The average price of attached homes was up over 18%. Contributing to the increase in average price of the attached home market was the continued growth of the upper-end attached home market in town of Jackson such as 810 West which saw 5 sales averaging over $1.6MM – perhaps making an argument for their inclusion in the Resort / second home market segment as opposed to their current categorization as a property in the Local market segment. Teton Village condominiums also contributed to the upward track of attached homes in Teton County, with an observed increase in activity in both older product and the newer “condo-tel” type homes such as Teton Mountain Lodge and Snake River Lodge and Spa. The latter of these housing types had an increase in volume in 2018 up to a year end tally of 24 units (compared to 17 units the year before).

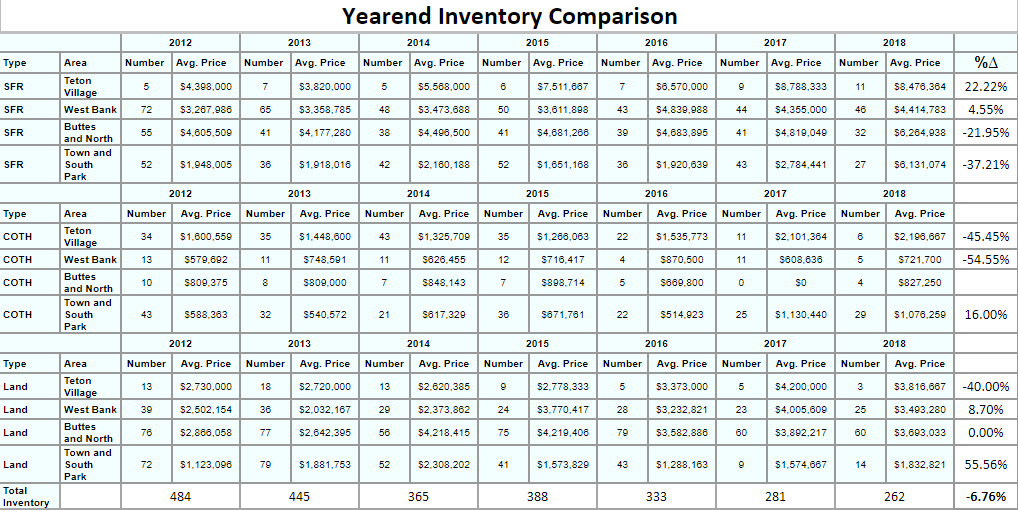

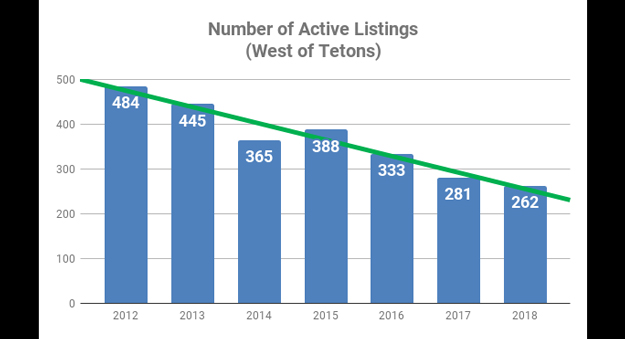

Inventory Levels

The preceding table arrays a year end snapshot of inventory levels for the past seven years. Inventory levels continue to remain low and are frequently cited by agents as a stagnating factor for sales volume levels. As shown by the preceding data, the combined inventory of single-family homes, attached homes, and vacant land listed for sale was approximately 7% lower at the end of of 2018 than this time last year, with limited inventory likely to be a factor for the foreseeable future.

Access to the most comprehensive sales database anywherefrom

the leading brokerage and appraisal business in Teton County.

Andrew Cornish – Broker

PO Box 9467 | 155 E. Pearl,

Suite 10

Jackson, WY 83002

(307) 733.8899

(307) 413.7799 cell

Linkedin

Data provided by Rocky Mountain Appraisals, Teton County’s leading valuation firm: www.rmappraisals.com

Data provided by Rocky Mountain Appraisals, Teton County’s leading valuation firm: www.rmappraisals.com